Introduction: Why Data Is the New Backbone of Collections In today’s digital banking environment, debt recovery can no longer rely...

Nextbit’s CaaS platform is equipped with comprehensive, enterprise-ready features that support secure, efficient, and compliant banking collection and debt recovery operations.

Nextbit is built on the vision of redefining banking collection and debt recovery through innovation and technology. With strong expertise in financial services and collections, we provide end-to-end digital solutions that help institutions improve recovery performance while maintaining trust and compliance.

Our Collection as a Service (CaaS) model integrates strategy, technology, operations, and governance into a unified platform, enabling financial institutions to streamline collections and focus on their core business.

Our mission at Nextbit (CaaS) is to empower banks and financial institutions with secure, intelligent, and technology-driven collection solutions that improve recovery outcomes while upholding the highest standards of compliance and ethical engagement. We strive to transform debt recovery through innovation, data-driven decision-making, and customer-centric digital experiences.

At Nextbit (CaaS), our values are rooted in integrity, compliance, and innovation. We are committed to ethical recovery practices, data security, and regulatory adherence while continuously leveraging technology to deliver transparent, efficient, and customer-respectful collection solutions for banks and financial institutions.

Nextbit offers a full suite of technology-driven collection and debt recovery services designed to support banks, NBFCs, and financial institutions across the complete delinquency lifecycle. Each service is powered by our Collection as a Service (CaaS) platform, ensuring efficiency, transparency, scalability, and regulatory compliance.

Nextbit enables intelligent digital communication with borrowers through a secure, omnichannel framework. This includes SMS, email, IVR, WhatsApp, chatbots, and digital customer portals. Communication journeys are automated and personalized based on borrower profiles, delinquency stages, and repayment behavior.

This service improves contactability, enhances borrower responsiveness, and ensures consistent, respectful, and compliant engagement while reducing manual follow-ups and operational costs.

Nextbit provides advanced field tracking and workforce monitoring capabilities to ensure effective and compliant on-ground recovery operations. GPS-based tracking, route optimization, and activity logs offer real-time visibility into field movements and task completion.

This service helps institutions improve field efficiency, prevent misconduct, enhance accountability, and maintain accurate audit trails for regulatory and operational oversight.

Nextbit’s Litigation Management System digitizes and streamlines legal recovery processes. The system manages case initiation, document management, court tracking, advocate coordination, and status updates through a centralized platform.

Real-time visibility, automated reminders, and detailed reporting enable institutions to control legal costs, reduce delays, and maintain compliance throughout the litigation lifecycle.

Enhance and expedite debt collections with Credgenics’ innovative and AI powered Collection-as-a-Service (CaaS) capabilities across the retail and SME loan portfolio. Automate the collections process, leverage Machine Learning insights, boost efficiency, and modernize the end-to-end loan recovery approach to ensure timely and effective repayments.

With growing financial awareness and digitization, lenders face the dual challenge of meeting customer expectations while ensuring efficient debt recovery.

Our digital collections service leverages advanced analytics and automation to manage early, mid, and late-stage delinquencies. Borrower segmentation, risk scoring, and strategy allocation are driven by AI-powered insights, enabling institutions to prioritize high-impact accounts and optimize recovery outcomes.

Real-time dashboards and MIS reporting provide complete visibility into portfolio performance, agent productivity, and recovery trends.

Nextbit enables seamless and secure digital loan repayments through integrated payment gateways and digital channels. Borrowers can make payments instantly using UPI, net banking, debit cards, and other digital modes.

Automated reconciliation, real-time payment confirmation, and instant ledger updates reduce delays, improve borrower convenience, and accelerate cash flow for financial institutions.

Improve borrower contact and streamline your contact center operations with the DialNext, Credgenics AI-powered dialer for debt collections. Optimize outbound & inbound calling using machine learning-driven borrower risk segmentation, real-time monitoring, and telecaller activity tracking. DialNext’s advanced auto and predictive dialers ensure seamless calling efficiency, and higher success rates in debt collections.

Our platform includes built-in compliance and governance frameworks aligned with RBI guidelines and industry best practices. Features include role-based access, approval workflows, call and interaction recordings, complete audit trails, and policy enforcement controls.

This service ensures ethical recovery practices, regulatory adherence, risk mitigation, and institutional accountability across all collection activities.

The Nextbit Collection Field App is a secure, mobile-first solution designed for field collection teams. The app enables agents to access assigned cases, borrower details, visit schedules, and collection instructions in real time.

Key features include geo-tagged visit tracking, digital acknowledgements, on-the-spot payment capture, document uploads, and instant system updates—ensuring transparency, productivity, and compliance in field operations.

Our inline dispute resolution service allows borrowers to raise disputes directly through digital channels during the collection process. Disputes are captured, categorized, and routed through predefined workflows for timely resolution.

This reduces escalations, improves transparency, enhances borrower trust, and ensures disputes are handled in a compliant and auditable manner without disrupting recovery operations.

Nextbit delivers comprehensive analytics and MIS services that provide actionable insights into collection performance, borrower behavior, and operational efficiency. Custom dashboards, predictive reports, and KPI monitoring enable data-driven decision-making at every level.

Continuous insights help institutions refine strategies, improve productivity, and achieve sustainable recovery outcomes.

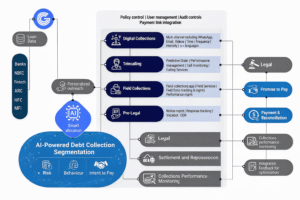

Our Digital Banking Collection & Debt Recovery service delivers an end-to-end, technology-driven recovery framework designed specifically for banks and financial institutions. Powered by AI, advanced analytics, and omnichannel communication, the service enables intelligent customer segmentation, predictive delinquency management, and personalized engagement strategies across voice, digital, and field channels. Built with compliance-by-design, the platform ensures adherence to regulatory guidelines while providing real-time monitoring, audit trails, and performance dashboards.

“A comprehensive 360-degree fintech platform that seamlessly manages the entire banking collection and debt recovery lifecycle—from early-stage engagement and AI-driven outreach to legal resolution, payments, and performance analytics."

“AI-powered collection and resolution that intelligently segments borrowers, predicts intent to pay, and orchestrates the most effective engagement across digital, telecalling, field, and legal channels. ”

“Built with strong control and compliance at its core, the platform enforces regulatory guidelines, audit trails, and role-based governance across every stage of the collection and recovery lifecycle."

“Expert views, industry news, and thought leadership on modern banking collections and debt recovery.”

Introduction: Why Data Is the New Backbone of Collections In today’s digital banking environment, debt recovery can no longer rely...

Introduction: Why Customer Experience Matters in Collections Customer experience has emerged as a defining factor in modern banking collections. Regulatory...

Introduction: A Turning Point for Banking Collections Banking collections and debt recovery are entering a decisive transformation phase. Rising credit...

To send us your requirements, please email us your phone number and your complete requirement details.

nextbitcollection@gmail.com

J1 & J2 Kailash Park, New Delhi - 110015

“Digital transformation in collections is no longer optional—it is a competitive necessity. NEXTBIT bridges the gap between traditional banking systems and next-generation FinTech solutions, enabling institutions to modernize without disruption.”

© 2025 Created with Nextbitcollection.com